This article, by Robert Kosuth, originally appeared in the Zenith City Weekly LLC, Volume 9, Issue 141, September 1, 2015.

On June 3, the Minnesota State Board of Investment voted unanimously to end consideration of human rights in their investment decisions.

The State Board of Investment (SBI) manages $80 billion in assets used to pay for state pensions and other trusts. In 2014, SBI saw an 18.6 percent yield, with an annualized return over the last 10 years of 8.4 percent.

SBI’s authority rests in four officers outlined by the state constitution—the attorney general (currently Lori Swanson), the secretary of state (currently Steve Simon), the state auditor (currently Rebecca Otto), and the governor (currently Mark Dayton) as chair. The officers supervise a staff headed by Executive Director Mansco Perry.

The vote on the June 3 resolution was initially split 2–2, with Dayton and Otto opposed. Perry repeated the major points of the resolution and they voted again, this time 4–0. But none of the constitutional officers is eager to discuss his or her vote.

Spokespeople for Dayton and Simon did not respond to multiple phone and email requests for comment. Ben Wogsland, a spokesman for the Attorney General, refused to accept questions and deferred comment to Perry.

Jim Levi, a spokesman for the Auditor, accepted questions, but deferred response to the June 3 meeting minutes, which, as of press time, had not yet been released. Levi read a prepared statement from Otto: “If I’m approached about potential investments, I refer them to SBI staff. If I’m approached about divestment of any of the investments, I listen. Everything I do on the Board I do as a fiduciary and according to state law.”

State law requires SBI to follow the “prudent person rule,” meaning the Board is to manage the state’s assets as carefully as they would manage their own. The law includes a few clauses about the types of allowable investments, as well as risk and performance standards, but the four constitutional officers have considerable latitude in setting SBI’s policies and making investment decisions.

Former Duluth Representative Mike Jaros was in the state legislature in the ’80s when it first passed divestment resolutions stemming from human rights concerns. “I think our resolution said that the Board should not invest in South Africa.” Jaros says the resolution was well received and passed easily.

In 1992, the Board adopted task force recommendations to consider human rights in its investment decisions. In its summary, the task force examined 34 countries, including South Africa, China, and Israel, but the details are only available in the full task force report. SBI accepted a data request for the full report last April, but a few weeks later, SBI Chief Operating Officer LeaAnn Stagg called to say the full report couldn’t be located.

Union leaders were involved in SBI’s human rights issues in the ’90s, but have since been silent. AFSCME Council 5 head Eliot Seide was on the task force in 1992, but Council 5 Public Affairs Director Jennifer Munt responded to questions via email. “It would be best to interview someone closer to recent actions to change the investment policy.”

UNITE/HERE did not respond to requests for comment, despite appearing at an SBI meeting in 2013, seeking support for one of their workers who was employed by a firm connected to one of the Board’s investments.

Having now withdrawn its human rights policy, SBI is free to continue giving taxpayer money to entities flagged by Human Rights Watch, Amnesty International, and the United Nations Commission on Human Rights.

Through SBI, Minnesota invests in scores of Chinese companies or those doing business in China, including more than $40 million stock in the Bank of China and $190,000 in Taiwan’s Foxconn, an electronics manufacturer notorious for its 2010–13 employee suicides in protest of working conditions.

Chinese labor law fails to meet international standards. Average manufacturing wages are 25 cents an hour and workers lack the right to organize. The Chinese government persecutes dissidents, censors the press, and displaces farmers to give their land to developers.

SBI owns more than $35.5 million stock in Rio Tinto, a mining company that holds mineral exploration leases to 36,000 acres of Minnesota land. Through its Kennecott subsidiary, Rio Tinto is drilling for copper, nickel, and other precious metals in Aitkin and Carlton Counties.

Rio Tinto’s environmental record—from burning PCBs in Utah to groundwater contamination at Wisconsin’s Flambeau mine—and its record of union–busting and squalid working conditions prompted Norway to divest from Rio Tinto in 2008.

SBI owns over $100 million stock in Royal Dutch Shell, which paid out $15 million in 1996 to settle a lawsuit over the oil company’s collaboration in executing tribal leaders in Nigeria. Despite promoting itself as a sustainable energy company, Shell has been linked to dozens of oil spills, fires, and toxic dumps.

SBI owns $80 million stock in Coca–Cola, whose Colombia subsidiaries were accused in 2003 of contracting with paramilitaries to kill union organizers.

SBI owns $100 million in bonds and dozens of companies in Israel, which has conducted a violent military occupation of the Palestinian Territories since 1967. Sometimes compared to South African apartheid, Israel walled off the West Bank, imposed a blockade on Gaza, set up military checkpoints that restrict Palestinian access to jobs, education, and medical care, and built civilian settlements on Palestinian land—acts declared illegal by the United Nations and the International Court of Justice.

Israel engages in targeted assassination and disproportionate force (e.g., a crime by a Palestinian prompts Israel to respond with ground troops, home searches, and bombing civilian targets like schools or hospitals).

“We have a fiduciary responsibility to maximize the returns,” says SBI Executive Director Mansco Perry. “Absent a legislative mandate, the sole criterion is to exercise fiduciary responsibility, to maximize returns.”

Perry says SBI’s investment decisions are “very apolitical…We invest in most stocks around the world. When it comes to choosing one or the other, the factors are weighed to try to determine which will give us the best return. We also have to take diversification into consideration, not just the simple, ‘I like A and I don’t like B.’”

But it’s hard to make a case that SBI’s divestments have not been influenced by parallel political trends. In addition to South Africa, the legislature restricted SBI from investing in Northern Ireland in the 1980s and it currently prohibits investment in Iran and Sudan.

More importantly, SBI’s behavior does not suggest its decisions are apolitical.

In 2011, SBI was sued by Minnesota Break the Bonds, an organization seeking divestment of publicly held stocks and bonds in Israel. [Author’s disclosure: I’m a member of Break the Bonds, which has been attending SBI meetings since 2009.]

Opposition to divestment was led by the Jewish Community Relations Council, where Secretary of State Steve Simon serves on the board of directors in addition to being a constitutional officer of SBI.

The Council retained St. Paul attorney Charles Nauen, who was Dayton’s lead attorney in the 2010 Dayton–Emmer vote recount. In addition to contributing to both Dayton and Swanson’s campaigns, Nauen “spent election night with Dayton in case elections issues came up,” according to the Star Tribune. Nauen also represented Otto last year in an election dispute with Matt Entenza.

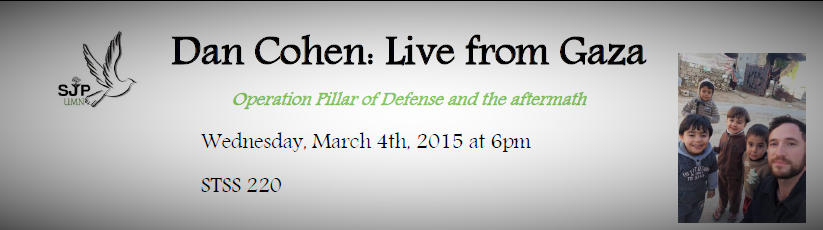

Break the Bonds’ lawsuit was dismissed for lack of standing, but SBI considered a divestment motion at its quarterly meeting on March 4, 2015. After comments from the Arab–American Anti–Discrimination Committee and the Jewish Community Relations Council, Dayton presented a motion declining to divest from Israel. Simon seconded the motion, opening the floor to discussion.

A member of the public asked the Board to speak louder so observers could hear them, and Dayton replied that they are not required to.

After repeating the mantra of “fiduciary duty,” Swanson asked Perry about the lawsuit. Perry said the court upheld SBI’s right to invest in Israel bonds, but he did not mention the human rights issues in the suit.

Swanson noted that Israel bonds yield more than treasury bills (2.4 percent versus 1.54 percent). Perry said the rates were “competitive,” but made no reference to his 2014 report that SBI’s Combined Funds yielded 18.6 percent in 2014 and 8.4 percent annualized over 10 years.

Simon, making no mention of his board position with the Jewish Community Relations Council, stated, “I will be voting today according to our fiduciary duty, and on that alone.”

The motion passed 3–1 with Otto opposed after reiterating her concern that, “Politics should not drive our decisions, as we are fiduciaries.”

Followed three months later by the Board’s vote to no longer consider human rights, labor rights, or environmental concerns in its investment decisions, Minnesota pensioners can now be assured their retirements are funded in part by human misery, military violence, and the destruction of the planet.